The Jersey Financial Services Commission says it is receiving an increasing number of queries concerning cryptocurrency, non-fungible tokens and other virtual assets.

The regulator's 'Innovation Hub' provides guidance to Jersey businesses requiring guidance on how emerging technologies are affected by regulatory framework.

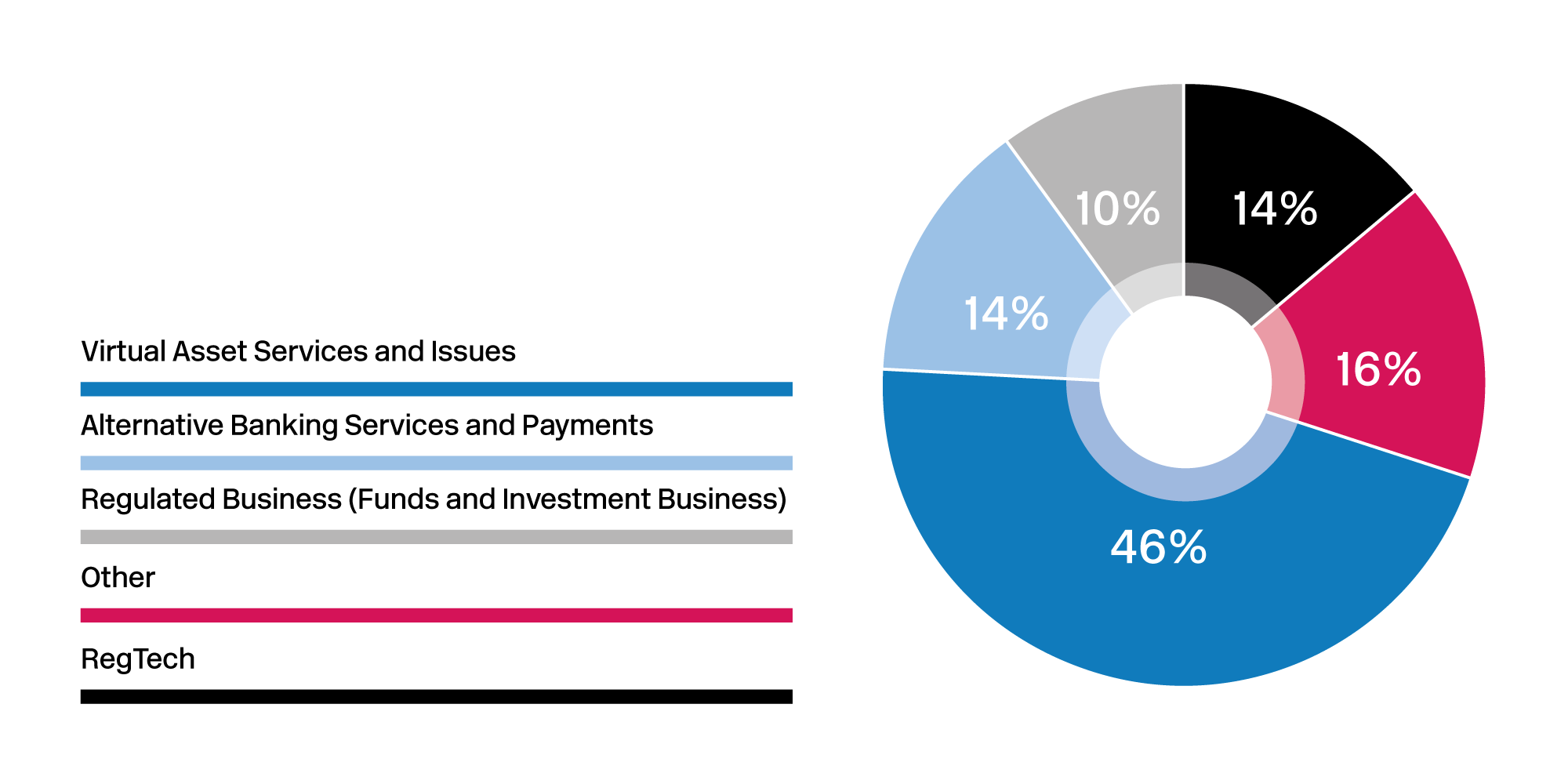

77 businesses approached the JFSC last year with queries relating to innovating in the finance industry.

At 46%, almost half of all enquiries received in 2021 related to virtual asset services and issues, they said.

Pictured: Interest in virtual assets grows - a breakdown of enquiries received by the JFSC Innovation Hub, by type.

A particular increase in interest regarding non-fungible tokens (NFTs) was identified in the second half of 2021. NFTs relating to visual art, music or e-gaming collectibles were the basis of most enquiries.

The remaining questions related to alternative banking services and payments, funds and investment businesses, RegTech.

RegTech is the management of regulatory processes within the financial industry including regulatory monitoring, reporting, and compliance

Last year, the JFSC engaged RegTech Associates to help identify the “key barriers of adopting RegTech” in firms.

Pictued: Non-fungible tokens, or NFTs, are backed by blockchain technology and are often associated with digital files such as virtual art.

“Given the rise in popularity of virtual asset services globally it was no surprise that, for the second year in a row, most enquiries we received related to them,” Jill Britton, Interim Director General for the JFSC, said.

“In 2022, we will continue to work with the Government of Jersey and other stakeholders in establishing a comprehensive regime for virtual asset service providers and issuers in line with international standards and recommendations.”

She added: “Businesses are also continuing to explore the possibility of efficiencies and cost savings by utilising RegTech applications.

“We are committed to engaging with businesses to understand how their products and services meet our regulatory expectations.

”The industry can expect further updates on this in 2022 as our work progresses.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.