New figures have been shared which detail the complaints received about the provision of financial services in the Channel Islands.

The latest Public Complaint Statistics report by the Channel Islands Financial Ombudsman (CIFO) provides an insight into which industries, services, and locations were at the centre of complaints across the last quarter.

The CIFO supports public confidence in financial services by resolving complaints and pointing out where things could be improved.

Express took a look at the key points from the Q2 report...

Financial service providers (FSP) were twice as likely to have a case determined in their favour compared to a complainant.

Double the number of cases determined in Q2 were won by FSPs at 11%, whereas only 5% of cases were won by complainants (outside of mediated cases).

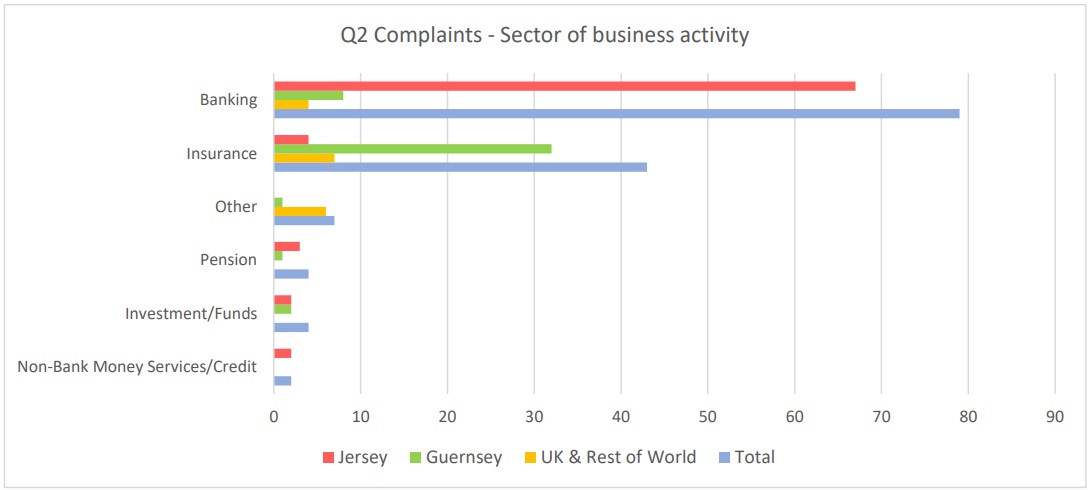

Banking in Jersey was by far the most complained-about sector, and the second most in Guernsey.

The insurance sector received the most complaints in Guernsey, but banking in Jersey still managed to garner almost double its number of complaints.

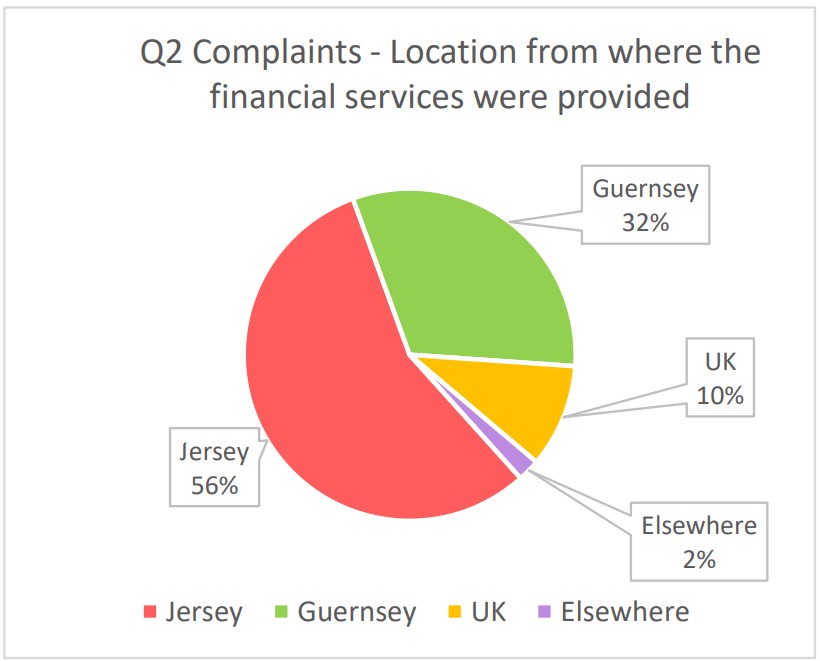

Jersey was the jurisdiction that received the most complaints about its financial services, with over half (56%) of complaints received by the CIFO relating to the island.

Around a third (32%) of complaints came from Guernsey-based service provision.

Although cases were more likely to be determined in favour of the FSPs last quarter, for the complainants that won their cases, it was worth their while.

93% of determined cases in Q2 received higher compensation than original offers from the FSPs.

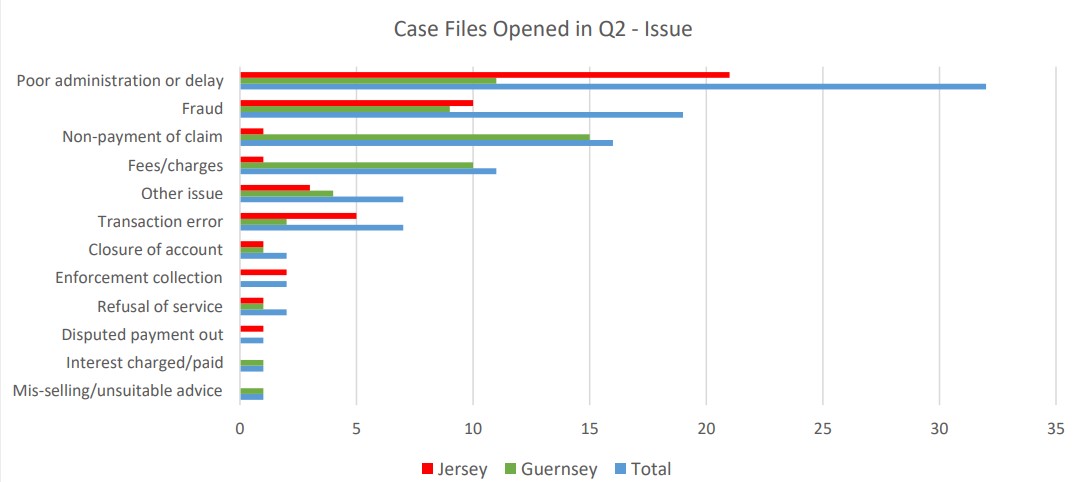

Service was the biggest issue for islanders between April and June of this year.

Poor administration or delays made up 32% of the case files opened by the CIFO this quarter.

Fraud was the second most common issue in 19% of case files, and third was non-payment of claim at 16%.

You can read the full report HERE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.