After years of preparation and millions of pounds in investment, the results of a rigorous examination of Jersey's finance industry have marked its anti-financial crime measures as being in good health – but more needs to be done to make money launderers "feel the pain".

That was the view of the Chair of the Global Coalition to Fight Financial Crime, who spoke to Express about the results of the Moneyval assessment of Jersey's finance industry published this morning.

In September 2023, a team of six assessors and a supporting secretariat from Moneyval – a European body that assesses if jurisdictions are doing enough to combat money laundering and terrorist funding – pored over documents and grilled individuals to find out if Jersey has to right tools to fight financial crime and how effective the island is at using them.

The stakes were high and while officials in Jersey expected there to be areas of improvement identified, the island was keen to avoid more punitive measures, such as being added to a ‘grey list’ of finance centres in need of close external monitoring. A grey listing could wipe hundreds of millions of pounds off the value of Jersey’s principal industry.

To prepare for the inspection, Jersey made a number of changes, including new legislation introducing Deferred Prosecution Agreements and making failing to prevent money laundering an offence.

It also wrote various new policy documents, including a ‘National Risk Assessment’, and beefed up personnel and resources in a number of agencies, with taxpayers funding more than 20 new full-time roles in finance-related supervision and enforcement at a cost of £1.8m.

It seems all the preparation was well-worth it, with the island scoring well.

With the 400-page report now in hand, the Government pointed to Jersey's strong result in understanding risk and co-operating nationally and internationally – where the island's effectiveness was marked "high", a result obtained by only three jurisdictions in the world.

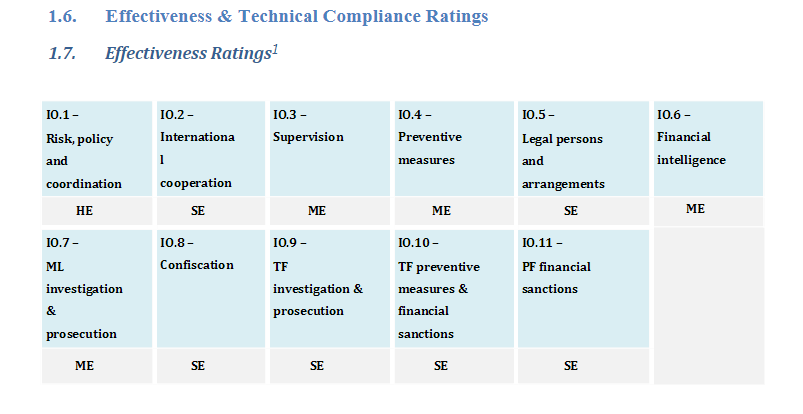

On the effectiveness of its measures, Jersey had one area – risk, policy and coordination – that was rated as "high". Another six areas were rated as "substantial".

Four areas were rated as "moderate" effectiveness: supervision, preventive measures, financial intelligence, and money-laundering investigation and prosecution.

Pictured: The key areas of assessment.

On technical compliance, Jersey was rated as "compliant" with 23 recommendations, "largely compliant" with 15, and "partially compliant" with one. There was no "non-compliant" rating.

But speaking to Express about the findings of the assessment, John Cusack, Chair of the Global Coalition to Fight Financial Crime, said the result was "good, but more needs to be done".

He said that while Jersey had "done extremely well to get positive results in 39 out of 40 [criteria], which puts it in the top 10% of countries", three areas were lacking: in the private sector, with regulators, and with money-laundering prosecutions.

"The purpose of this exercise... is ultimately to find bad guys who are generating big, enormous sums of proceeds of crime and benefiting from that – by banking it and using it, buying cars, buying houses, buying other things.

"The idea is to follow the money, and then take the money away from them in order to disincentivise them from carrying out the crime in the first place.

"How good are we at doing that? Not very.

"Money-laundering prosecutions are very low everywhere. There's a couple of places that are better than others. Jersey is no different from everywhere else.

"But it's not good enough, because the whole purpose of this exercise is to make it difficult for the criminals and for them to feel the pain."

However, he continued: "...Obviously you want to take crooks out and put them in prison, and we need to do more of that. But there's an alternative, you can take away the money that they've earned. Jersey has done better than most countries in that space. So that's a positive."

One of the key areas of the evaluation focused on "confiscation of proceeds", with Mr Cusack noting that Jersey is "probably in the top 10 countries on a relative basis on taking away people's money".

"Now, it's not surprising that you take away people's money, because people's money is sitting in places like Jersey," he explained.

"That's not a bad thing. Every financial centre is going to have some element of 'bad money'. The challenge is to identify it and then take it away from them. So Jersey is doing better than many on taking away the money, but is doing not as well as it should be on prosecuting money laundering cases and putting people behind bars."

Deputy Ian Gorst, External Relations Minister and the politician in charge of financial services, said the assessment “demonstrates Jersey’s ongoing commitment to complying with international standards".

"I hope that it gives the industry and investors confidence in the future of Jersey as a responsible international finance centre," he continued.

"We can use the report as a foundation on which to build sustainable and reliable growth by using it to show that Jersey takes effective action to prevent the channeling of illegal funds, and enable honest and transparent economic growth around the world.

“The work to combat financial crime is not over, and never will be. Like every other jurisdiction Jersey will have to continue to adapt to meet changing threats. The report endorses our current national strategy and much of the work we are already doing, but we will also address the recommendations made for improving our system. We will do so in a proportionate and reasonable manner, and through proper consultation with industry."

Commenting on the Report, Joe Moynihan, CEO of Jersey Finance, said the report was a "strong endorsement of Jersey's capabilities as a jurisdiction in combatting financial crime and reflects its commitment to upholding the very highest standards on the global stage".

He added that it should send a "powerful and positive message to investors around the world and give them confidence in Jersey's current and future standing", adding that it "reflects in particular the substantive joined-up approach of our industry, working in tandem with the Government of Jersey, the Jersey Financial Services Commission and other agencies, and we thank them all for their efforts to evidence Jersey's standing as a responsible and reputable jurisdiction".

"Recognising that the long-term direction for international financial services is towards greater sophistication in tackling financial crime, we remain committed to delivering this as a jurisdiction to stay at the forefront of cross-border financial services," Mr Moynihan concluded.

You can read the Moneyval report here.

Follow Express for more analysis and updates on the Moneyval report...

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.