The Taxes Office hopes employers will save one New Year’s resolution for them this winter: to get to grips with the start of combined employer returns.

From 1 January, the way businesses in Jersey report to the Government with details about employees’ income tax, social security contributions and manpower information is changing.

Revenue Jersey is confident that it will not only make it easier for employers but it will also improve its collection and use of data – helping Government make better decisions about population, skills shortages and other key policies.

The new system – which should affect 4,500 employers - begins on 1 January with the first filing deadline on 15 February.

Pictured: Head of Revenue Jersey Richard Summersgill.

Tax Comptroller Richard Summersgill said: “At the moment, tax information is submitted monthly, social security contributions are quarterly and manpower returns are half-yearly.

“This brings them all together in one online form. It should simplify things for people as it should require less work every month, becoming a routine for those dealing with payroll.

Pictured: Both employers and employees need to be aware of the changes.

“It will be more reliable, more accurate, more joined up and more user friendly, as well as improve the accuracy of data which informs Government policy.”

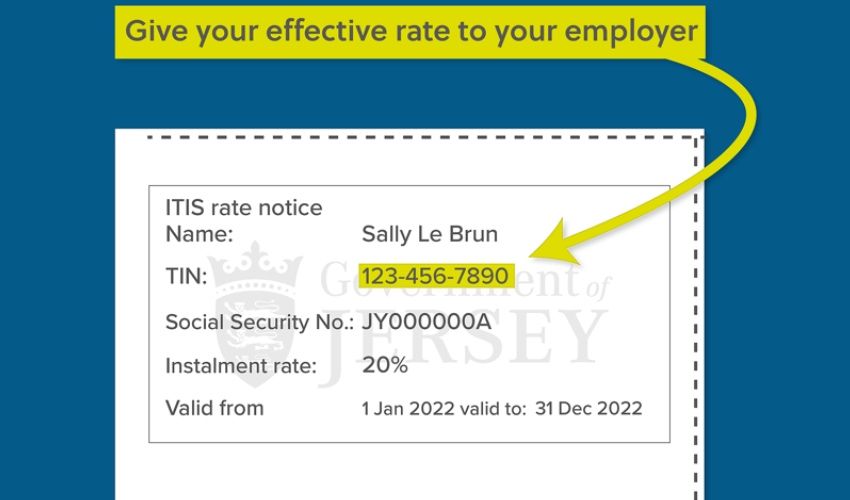

Revenue Jersey also has a message for employees: get your effective notices in as soon as you can. These now include a tax identification number, which employers will need to have to make the new system work.

The department says this is its most significant development since its ‘Tell Us Once’ initiative.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.