Politicians will this week vote on whether the island should borrow three-quarters of a billion pounds to pay for a new hospital. Here, Express answers some of the fundamental questions of what’s at stake...

The Government argues that, in this time of historically low interest rates, taking out a bond is the best way to fund the £804.5m hospital.

The Scrutiny panel of politicians tasked with reviewing their plans, however, say that that is far too expensive, and the States should limit spending to just over a half-a-billion pounds instead.

It is worth stressing that the debate this week is not about site selection - the Assembly has already agreed that the new hospital should be built at Overdale.

A number of islanders are strongly opposed to the Overdale option. However, the debate is specifically about how it should be funded.

That said, if the Assembly backs Scrutiny's amendment to halve the cost of the project, it would certainly force the Government and the Our Hospital project team to go back to the drawing board.

The headline cost is £804.5m – although with interest payments it will cost more than that over the 40 years that the Government plan to repay the bond.

The biggest cost within the £804.5m is unsurprisingly the main project works (£311.7m).

Other big budget items include: preliminary work (£53.4m), design and professional fees (£33.6m), equipment (£56.3m), land acquisition (£34.3m), costs of the Government’s own hospital project team (£39.5m, with £29m of that going to consultants), ROK FCC JV’s profit and overhead (£44.7m, which is based on 9.5% of the contractor’s total costs) and inflation (£34.6m).

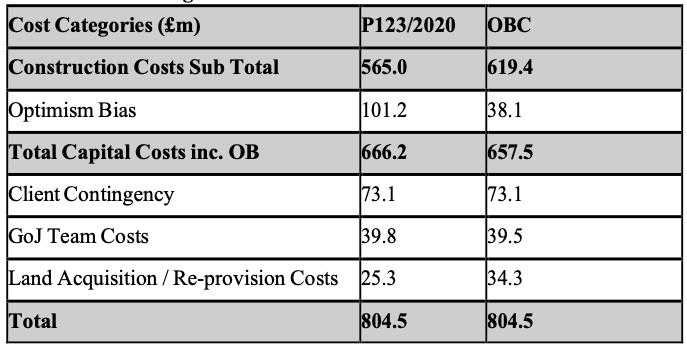

Pictured: How costs have changed between when the States voted to build the hospital at Overdale last November (P.123/2020) and this week's Outline Business Case (OBC) funding debate. The overall £804.5m cost is unchanged.

There is also a £73.1m ‘client contingency’ – which is set aside to cover unexpected costs that the Government might have to cover. ROK FCC JV has its own £35.8m ‘contractor contingency’ in case it faces unforeseen costs.

Another £38.1m is something called ‘optimism bias’, which is a common feature of construction, where cost estimates at the very beginning of a project are usually pitched high to provide a budgetary safety net.

While this bias will come down as true costs are firmed up, it is usually replaced by other unforeseen costs, but it should be “very low” by the time construction begins.

It has already come down from an initial £101.2m predicted last year, but construction and land acquisition costs have risen since then, cancelling out any gain.

The Government expects to spend £58.4m this year on capital costs, which will rise to £85m next year, followed by £181.7m (2023), £287.4m (2024), £169.6m (2025) and £11.3m (2026).

That £804.5m budget is the maximum amount, say the Government, and cannot be exceeded without the approval of the States Assembly.

If borrowing repayments are taken into account – and the Assembly backs the borrowing option – the project will cost £1.4bn in total.

That is, if the Government secure a bond with an annual charge of 2.5%, which it is confident it can get.

The Government does not intend to take out the equivalent of a 100% mortgage.

This isn’t because it has to make a deposit – it’s taking out a bond rather than a mortgage – but because it has already spent just over £60m getting the project to this point.

So far, it has used general revenues to pay the bills, although part of the borrowed money will go back to capital projects which had received funding in the last Government Plan but have not started yet.

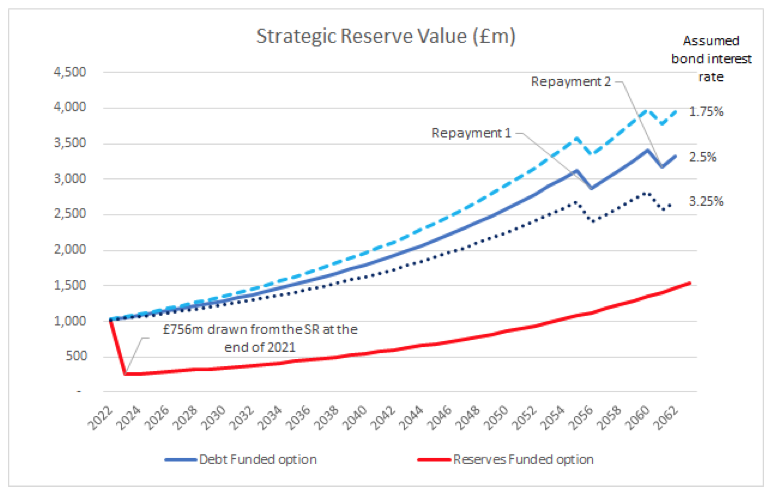

Pictured: The Government say that the Strategic Reserve will be better off if borrowing is used to fund the new hospital.

Needing to pay hospital project costs this year, before funding had been agreed, the Treasury Minister decided to raid these pots of capital money, handing out ‘IOUs’ to the departments involved.

So, the Government wants to borrow £756m but will give £12.7m of that back to those raided pots. That leaves £743.3m left, which will pay for everything to get the hospital up and running - and ready for its first patient in 2026.

£21m of the £743.3m will be spent this year.

The Government plans to split the £756m it wants to borrow into two £378m bonds – one paid over 35 years and the other paid over 40 years.

Ministers argue that, if it wrote a cheque for £804.5m and paid for it now out of the Strategic Reserve (otherwise known as the Rainy Day Fund), yes, the island would be debt-free, but the £1bn back-up fund would be down to about £250m.

However, if it borrowed £756m and added that to the Strategic Reserve – increasing it initially to £1.75bn – over the course of the repayment period, its value will increase a lot more than a depleted fund would, despite the capital and interest repayments.

The Government estimates, with bonds with 2.5% coupons, the Strategic Reserve will be worth £3.3bn by 2062, when the 40-year bond will be paid off.

The Government and Our Hospital team has carried out a cost exercise which they say proves that its option is the best one.

It costed up a ‘baseline comparator’ – which was refurbishing the existing health estate up to the latest standards, including giving each inpatient their own room.

This, they concluded, would cost £940.2m - £135.7m more than the Overdale new-build option.

The Future Hospital Review Panel is calling for the total budget of the hospital project to be reduced from £804m to £550m, with a maximum cap of £400m on borrowing.

The panel employed their own technical advisers, who have concluded that the Government’s Outline Business Case does not provide the evidence needed to justify the scale of the project, as it is currently outlined.

Their report also raises concerns about what they argue are departures made from the accepted compliance model – set out in the HM Treasury’s ‘green book’ - for such reports.

Pictured: Scrutiny argue that the cost of the new hospital should be capped at £550m instead of £804.5m.

The panel, led by Senator Kristina Moore, also employed the services of the Chartered Institute of Public Finance and Accountancy, who were asked to examine the affordability of the proposed £804.5m budget and the economic impact of borrowing using two two public bonds of £378m each.

CIPFA concluded that the strategy may impair any future Government policy decisions and threaten the stability of its current medium and long-term financial strategy.

In essence, the panel say the project is too big, too costly and Members don’t have enough information to put the island almost one billion into the red with a simple press of their ‘pour’ button.

As well as recommending a cut in the budget, Scrutiny is calling on Senator Farnham to better outline how the Our Hospital plans align with the Jersey Care Model, provide more details about plans for more private beds at the new hospital, and give a clearer picture of what the hospital’s running costs will be.

Push to cap future hospital spend at £550m

Survey signals opposition to £800m hospital borrowing plan

INSIGHT: Unpacking the plan to build a hospital at pace

Progress Party to push for new hospital on current site

“The hospital is much more than just the number of beds”

New hospital 'must be built now' to avoid NHS competition

Gov expect credit rating downgrade due to £750m hospital loan

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.