The Government has once again been warned by its economic advisers not to keep all its eggs in the finance basket, as doing so presents a key "risk" – but the plan is still to grow the sector as much as possible.

Deputy Elaine Millar highlighted the need to "protect" and "promote" the finance industry and said that Jersey's successful performance during the rigorous Moneyval examination of its anti-financial crime measures will be a helpful way to promote and bolster the industry.

Her comments came following publication of the Fiscal Policy Panel's latest annual report, which provides analysis on the government's spending plans as well as the state of the island's economy.

Deputy Millar said: "There are some positives in the sense that they [the FPP] have welcomed the work we've started in terms of topping up the strategic reserve and the stabilisation fund.

"They would like us to do more and I understand that.

"I understand the rationale for building up the reserves and it's something we will need to continue to work on."

Pictured: Treasury Minister Elaine Millar with a copy of the Fiscal Policy Panel's report.

The FPP made a number of observations regarding the financial services sector's strong performance last year, but suggests that "dependence" on the sector is "a source of risk".

The Panel explains that this is because "many of the factors that determine financial sector revenues and profits are outside Jersey's control".

Deputy Millar said that Economic Development Minister Kirsten Morel was exploring ways to diversify and build the economy.

"There's good reason for doing that, in terms of providing people with alternative careers," she continued.

Two opportunities previously touted as big opportunities for the island were making Jersey a world leader in cannabis growth and production, and encouraging 'set-jetting', with the possible creation of a local screen commission in the wake of the island's starring role in The Apprentice, and the upcoming Bergerac reboot.

While the latter remains underway, it was confirmed this week, however, that plans to create a strategy to grow the emerging cannabis sector had been sidelined due to "resource constraints".

Pictured: The economic experts within the FPP highlighted dependence on the financial services sector as a "source of risk".

Deputy Millar noted that the 'Pillar Two' tax reforms "change the environment globally with financial services" and that the government will be looking at how to ensure Jersey "is a competitive environment, that people still want to come here, what we offer as an island that brings people here, keeps them here and allows them to then grow the business.

"Although that may be primarily focused on financial services, it will have benefits across all sectors."

Deputy Millar also highlighted the need to "protect" and "promote" the finance industry, citing the recent Moneyval assessment as an opportunity to do so.

"We had a very good Moneyval report which says we have a good regulatory framework and with that report, that is something we will be using to grow the industry.

"You want to grow financial services as much as you can."

The FPP concluded that the island's financial services sector "has been experiencing a period of strong growth", citing a 19% increase in real GVA in 2022.

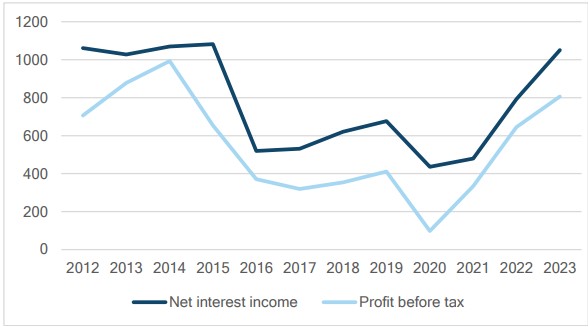

It explains that: "This was driven entirely by the banking sub-sector benefiting from an increase in net interest income (the difference in interest rates charged to borrowers and paid to deposits) and was caused by interest rates in the UK, US and EU increasing at the fastest rate for decades, reaching levels not seen since before the 2008 global financial crisis."

It points out that this has driven up profits for Jersey’s banks, with net interest income increasing by 33% in 2023 to reach £1.05 billion.

A graph showing how an increase in net interest income has driven up profits for Jersey’s banks. (FPP report)

It added: "Despite cuts to base rates in the UK, US and Eurozone in 2024, base rates remain at a level that allows banks to achieve a net interest rate margin and strong profits.

"The Panel assesses financial services sector profits growth to have been very strong in 2023 at around 40%."

However, the FPP also predicted that the figure will drop down to around 6% this year and 4% in 2025.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.