The Government has guaranteed a £2.5 million overdraft for Beaulieu after the all-girls private school suffered such significant losses that it was on course to become insolvent at the end of last year, Express can exclusively reveal.

Financial documents obtained by Express after queries dating back more than a year have shown how the longstanding Roman Catholic institution recorded a loss of more than £379,000 in 2022, and had forecast a loss of £1.2m for 2023.

An internal ‘Finance Update’ document published in June 2023 warned: “Without funding the school will become insolvent in the autumn – debt or grant money MUST be raised.”

The 800-student-strong school issued an apology to parents last January after an independent report uncovered leadership failings, a “lack of accountability and a dip in educational standards”.

Calls for a vote of no confidence in CEO Chris Beirne and COO Pippa Davidson-Coleshill followed, with Mr Beirne leaving with immediate effect in the same month, while Ms Davidson Coleshill resigned in November.

Beaulieu fought to make rapid improvements to its standards and governance in the wake of the report, and a follow-up review in May praised its swift and “effective action” – and that work is continuing today. But it's now emerged that the school has been facing another significant battle behind the scenes at the same time...

Shortly after the initial critical review, Express requested Beaulieu’s most recent financial statements.

While the school is independent, organisations receiving grants from taxpayers over £75,000 are required to submit annual accounts each year, which should in turn be made available for public scrutiny.

In 2019, Beaulieu received a £7.3million from the Government to build new classrooms, a sports centre, cafe and sixth form centre.

In addition, the school previously borrowed £500,000 from the Treasury in both 2008 and 2014 – amounts due repaid in full in 2022.

Like other private schools, Beaulieu also receives a weighted annual grant from Government to support curriculum delivery.

But Express was only able to obtain its 2019-2021 accounts following a request under the Freedom of Law, while the latest financial statements for the year ending August 2022 were only made available this week – despite the school saying in February that they were near to completion.

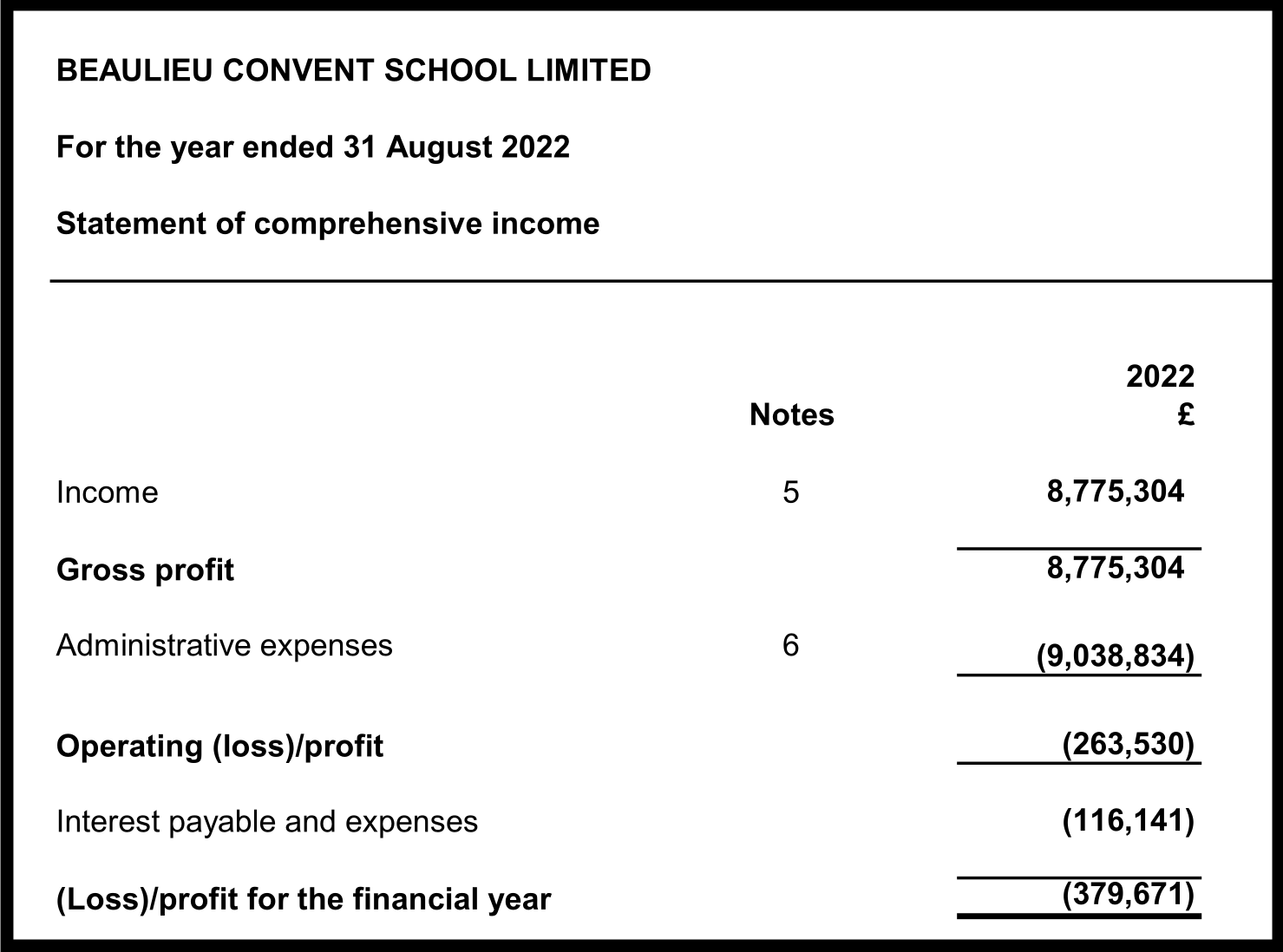

The 2022 accounts showed an overall loss of £379,671 for the financial year.

They explained that Beaulieu "has been experiencing negative cash flows in recent years following an increase in capital expenditure and suffered operating losses in 2022 and 2023 which necessitated an increased overdraft facility of £2,500,000".

Pictured: Beaulieu's 2022 financial statements were published this week after repeated queries from Express.

An internal ‘Finance Update’ from May 2023 highlighted a number of “key issues”, ranging from “unaffordable” capital repayments on the sports hall and a “not fit for purpose” government curriculum grant to “terrible” IT systems, a marketing function described as a “cost not a profit” and an apparent tendency to spend money “based on ‘what we have to do’ and not ‘what has been funded’”.

Maintenance, which was only being undertaken on a “‘needs must’ basis”, was also highlighted as a worry, with the report stating: “…things are just falling apart and costs are higher than previously anticipated.”

The Update assessed Beaulieu as being in a “precarious position” with the need for an overdraft “immediate”, on top of “lots of negotiation” with Government around its level of grant support.

Concerns over the level of distress the school was in were such that disaster scenario planning took place ensure the school would be able to avoid having to “hand control of the school to CYPES [the Government’s Children, Young People, Education and Skills Department]” – details of which, alongside the roots of the school’s financial woe, will be explored in further depth by Express next week.

Court documents obtained by Express have demonstrated how the school has since been working with Government to help bring stability to its finances, though none of that work has been acknowledged publicly by either party.

An Overarching Agreement registered in Jersey's Royal Court on 5 July 2024 showed that the Government agreed to provide a guarantee to NatWest for the school’s overdraft facility – up to the sum of £2.5m.

This means that, if Beaulieu Convent School Limited can't pay the overdraft, the Government will reimburse the bank up to the £2.5m limit.

Pictured: Royal Court documents obtained by Express demonstrated how Beaulieu had been working with Government as part of its first steps towards financial stability.

However, the agreement also featured a separate guarantee from Saint Meen Properties Limited, the company with responsibility for the freehold property and buildings of Beaulieu, which takes its name from the Saint-Méen-le-Grand in Brittany, the home of the Sisters of the Immaculate Conception who founded the school in 1937. It requires Saint Meen to reimburse the Government if it is required to cover Beaulieu Convent School Limited's overdraft.

Both Beaulieu Convent School Limited and Saint Meen Properties Limited are beneficially owned by Beaulieu Convent School Trust – the trustees of which are considered to be the common controlling parties of both companies.

In 2011, Beaulieu Convent School Limited and Saint Meen Properties Limited entered into an unlimited intercompany composite guarantee with NatWest to allow the school to access a £1.2m overdraft facility.

An unlimited intercompany composite guarantee is a financial agreement commonly used in corporate structures where multiple subsidiaries or related entities are involved. In this arrangement, one or more companies within a corporate group provide an unlimited guarantee to a lender on behalf of another entity within the same group – like Saint Meen on behalf of Beaulieu.

However, earlier this year, the Government also became involved in this agreement to allow Beaulieu to increase its overdraft to £2.5m until 31 August 2025 at an interest rate of 2% per year over base rate.

In the 2022 financial statements, Beaulieu described the increased overdraft facility as the "first phase of a return to financial stability".

"The agreement of the new overdraft provides financial stability for the 2024/25 academic/financial year and enables to board time to deliver the longer-term strategic plan," the statements say.

The overdraft agreement includes a requirement for Beaulieu to deliver a "long-term strategic plan for the school" by early 2025, which must be approved by the Government.

"The details of the plan are yet to be developed as this requires the input of the new Headteacher who formally takes up his new role on 1 September 2024," according to the accounts.

Matthew Burke became headteacher of Beaulieu in September this year, following the retirement of Chris Beirne.

Pictured: Former Beaulieu headteacher Chris Beirne left in September 2023 after 17 years in the role.

Following questions from Express about the £2.5m overdraft, Mr Burke said: "We have been working with our bank [NatWest] and with the States of Jersey as our primary lenders to ensure the financial structure of the school continues to meet our needs whilst also providing the flexibility to manage the school through a changing economic environment."

Beaulieu's most recent financial statements note that "significant progress has been made" since the documents were signed.

"Initial cost reduction measures were agreed and implemented prior to the 2024 Easter break with an improved focus on cost management as a result of which the Company's cash flow position has improved," it continues.

Just last month, two more contracts were passed through the Royal Court: a 15-year lease agreement between Saint Meen Properties Limited, Beaulieu Convent School Limited, and the Public of Jersey.

Pictured: The Treasury Minister said arrangement aimed to "ensure the good work of Beaulieu could continue without disruption, should the school face financial disruption."

Saint Meen has leased the entire Beaulieu Convent School complex – including the primary school, secondary school, and sports pitches – to the public for a nominal rent of £15 annually, who are in turn sub-leasing it to Beaulieu for £1 per year.

The school is responsible for maintaining the buildings and grounds, ensuring insurance, and complying with planning laws.

Deputy Elaine Millar, Minister for Treasury and Resources said: “The Government of Jersey has a responsibility to ensure the highest standards of education possible are maintained, and as such works closely with all the island’s schools.

“As a private school, Beaulieu is responsible for its own financial affairs. The Government of Jersey maintains a close working relationship with the school, which includes both an annual grant and loan for the construction of a sports hall as part of the school’s ongoing investment in its students."

She added: “Both the Government of Jersey and Beaulieu continue to prioritise the school’s staff and students – the lease is simply a precautionary measure to ensure the good work of Beaulieu could continue without disruption, should the school face financial disruption."

NEXT WEEK: Express investigates the sources of Beaulieu's financial woe, and the disaster-planning to get the school back on track and ensure it cannot be taken over by CYPES.

Follow Express for updates... Sign up to our FREE daily news email now to get all the latest headlines delivered to your inbox each lunchtime...

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.