Public opinion is divided on how islanders should repay their 2019 tax bill, if proposals to scrap the prior year tax system are approved.

Half of respondents to a Government survey say they do not support a five to 10-year period for repayment, a suggestion supported by 42%.

The Treasury Minister, Deputy Susie Pinel, announced plans to move islanders currently paying their tax in arrears - a system known as Prior Year Basis (PYB) - to Current Year Basis (CYB) in July.

The move, which is part of the government’s £150m stimulus package announced earlier this month, would affect roughly 45,000 islanders.

Pictured: The Treasury Minister, Deputy Susie Pinel, proposed moving islanders currently paying their tax in arrears - a system known as Prior Year Basis (PYB) to a Current Year Basis (CYB).

Under the Prior Year Basis system, if a taxpayer’s circumstances change and their income reduces, it can become difficult for them to pay a prior-year’s bill on a current year’s income.

Under the new measures being proposed, these taxpayers would be moved onto the Current Year Basis and pay their tax as they earn.

All tax payments made during 2020 would be moved at the end of the year to pay off the 2020 tax bill. Meanwhile, the 2019 tax bill would be frozen until January 2023 with a range of repayment options available.

Islanders were invited to share their views on the plans, which are subject to approval by States Members, in a Government survey, after the Treasury Minister wrote to all PYB and CYB taxpayers to inform them about the proposed changes.

2,387 islanders took part in the PYB Tax Reform Survey, which ran between 3 August and 2 September 2020, with a majority (52%) supporting the changes, while 38% said they were against them.

A third (34%) of respondents currently on the PYB system said their finances had been affected by the corona virus pandemic.

Half (50%) of respondents did not support asking PYB taxpayers to commit to paying their 2019 tax bill over 5 to 10 years while 42% did.

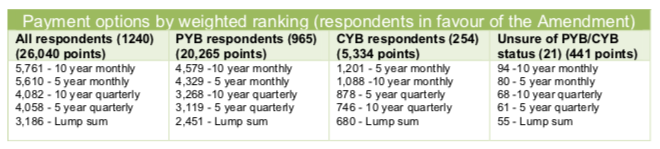

Pictured: A 10-year plan with monthly payments was the favoured option for repayment.

Respondents ranked a 10-year plan with monthly payments as their favourite option for repayment.

61% of all respondents expressed support for a financial incentive being offered to taxpayers who pay their bill in a lump sum in 2023, while 34% did not support the idea.

28% of respondents agreed with islanders being charged late payment interest if they take longer than 10 years to pay the 2019 tax liability.

Over 1,400 comments were submitted along the survey, a majority of which (544) referred to a partial or full write-off.

The issue was the subject of a petition from former Senator Ben Shenton which received 5,649 signatures, meaning it could be debated in the States Assembly if members decide to do so.

Pictured: Former Senator Ben Shenton launched a petition calling for the 2019 tax bill to be written off.

However, the Treasury Minister has repeatedly rejected the idea. In a statement released after the petition reached 1,000 signatures, Deputy Pinel said the petition’s demands weren’t viable.

“…I want to emphasise that the Government isn’t in a position to ‘write-off’ the 2019 tax bill, which amounts to £320 million, due to the additional covid-19 related costs the Government has had to meet over the last few months. In addition, such a move would not be fair to former PYB taxpayers who have already paid off their PYB liability, or to CYB taxpayers.”

In her official reply to the petition, she then emphasised that writing off the tax bill would not be possible as it would strike a £320million blow to the public purse at a time when the Government was having to carry "significant additional costs" to deal with covid.

The results of the survey will be used to inform the draft payment Regulations that will be published before the Amendment Law is debated in the States Assembly on 3 November.

The finalised payment term Regulations will be debated by the States Assembly in early 2021.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.