Jersey’s economy is performing better than pre-pandemic levels, new data has revealed – with growth being primarily driven by the finance sector.

Statistics Jersey last month published a report which measured the performance of the local economy last year.

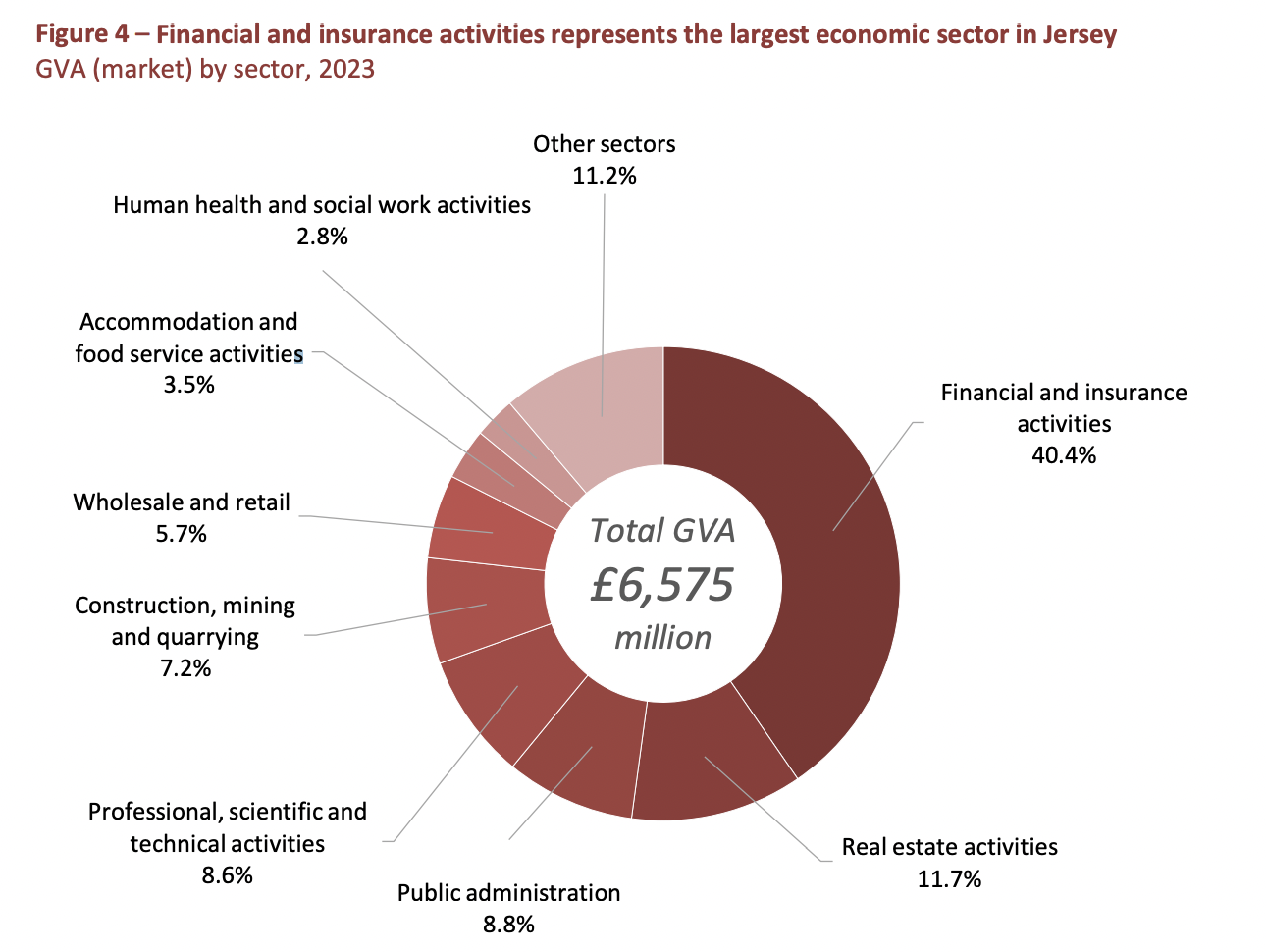

It revealed the island’s Gross Domestic Product – which measures the total value of all goods and services produced during a year – was £6.58 billion.

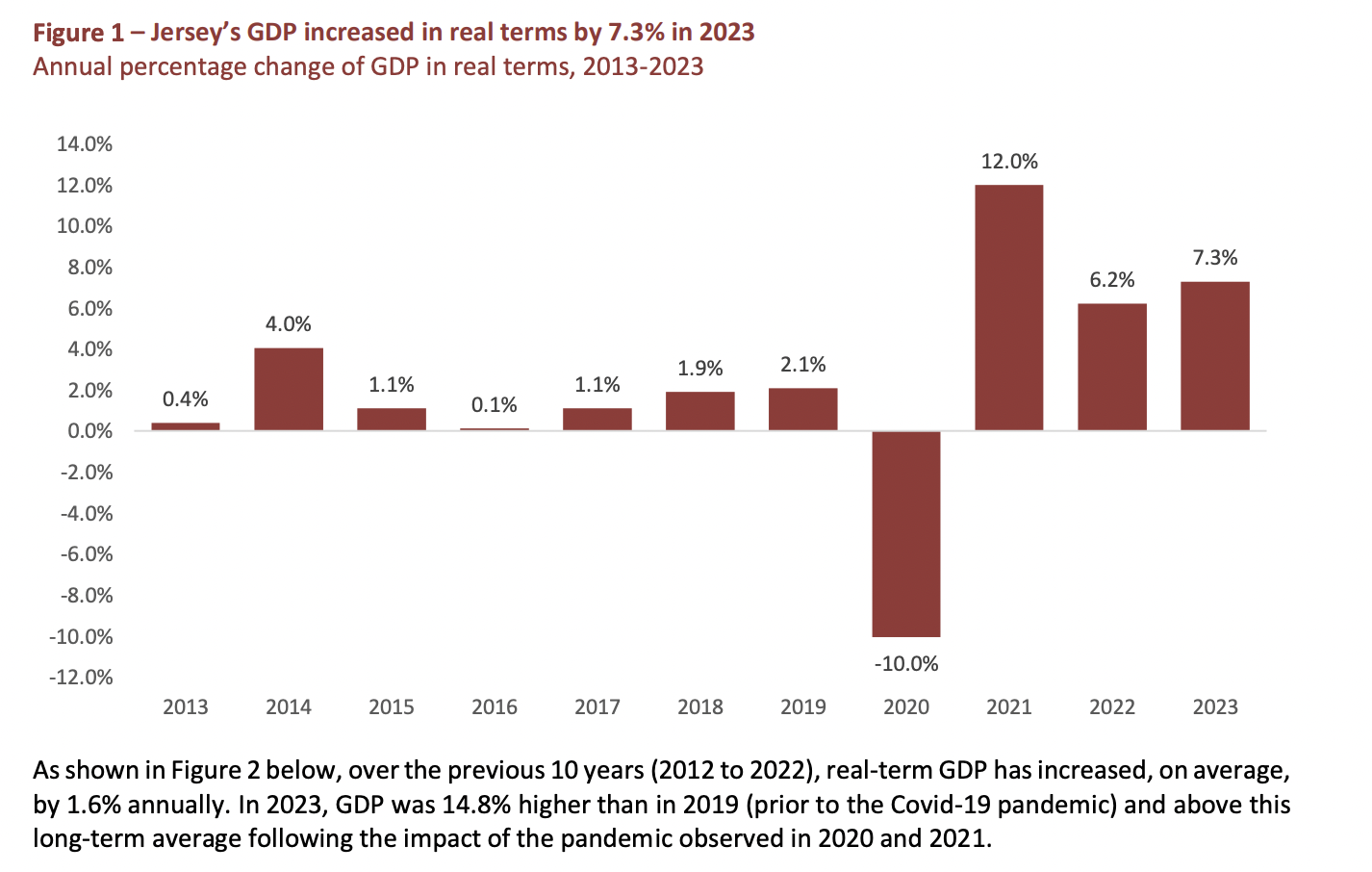

Pictured: Jersey’s GDP increased in real terms by 7.3% in 2023. (Statistics Jersey)

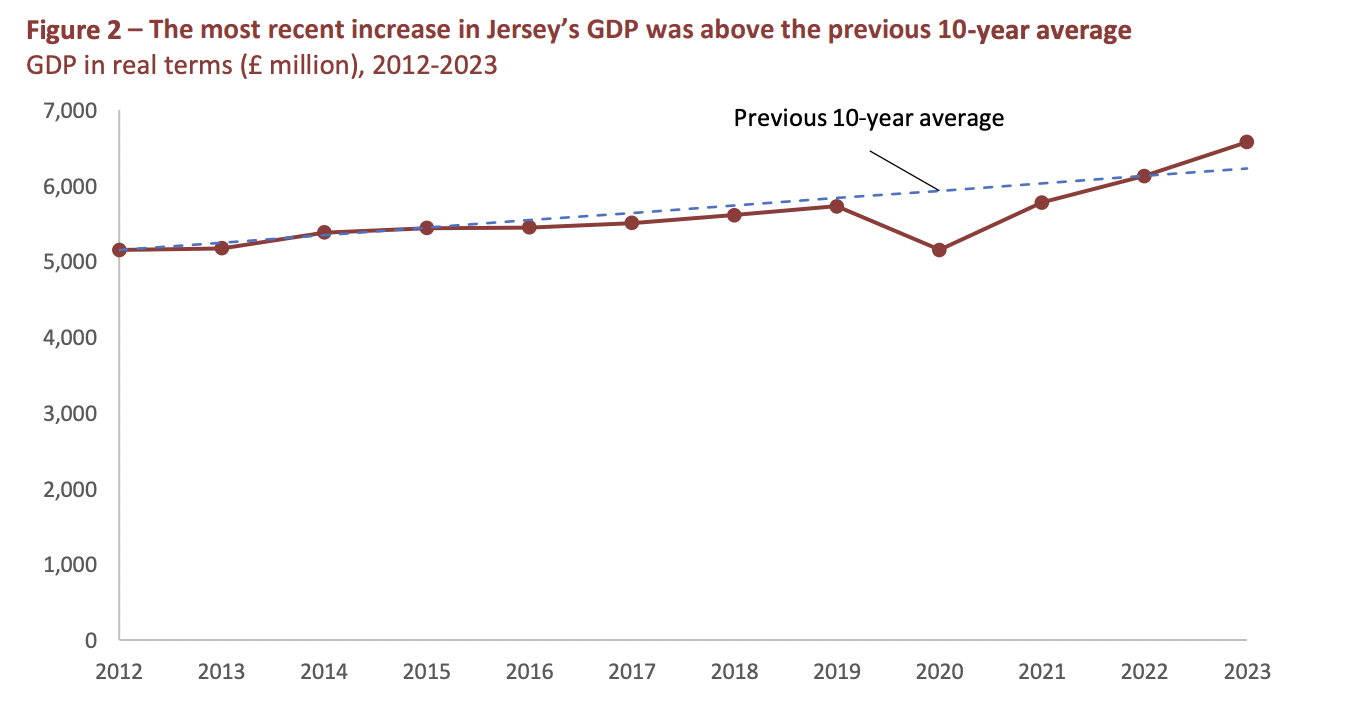

This marks a 14.8% rise in real terms compared to pre-pandemic levels in 2019, when GDP was £4.86 billion.

But what do these figures really mean, and why do they matter?

GDP measures the total value of all goods and services produced during a year. It helps assess the overall size and health of Jersey's economy over time by working out how much money the entire island is generating.

When GDP rises, it typically means the economy is growing, businesses are doing well, and more goods and services are being exchanged.

Pictured: The most recent increase in Jersey’s GDP was above the previous 10-year average. (Stats Jersey)

In 2023, Jersey's GDP grew by 7.3% compared to the previous year. To put this in perspective, a 7% rise significantly is higher than the average annual growth of 1.6% seen over the previous decade.

This higher-than-usual growth suggests the economy has rebounded from pandemic-related disruptions.

GDP per capita shows a country's GDP divided by its total population. It is a way to measure how much economic output is produced per person.

This measure gives a sense of the average standard of living as it adjusts for changes in population size.

In 2023, Jersey's GDP per capita rose by 7% to £63,500. This is an increase of £4,100 from the previous year.

In 2019, the GDP per capita was £45,320.

For islanders, this is a positive sign as it indicates a rising standard of living and better productivity.

It will come as no surprise to many that the main driver of the island's economic growth was the strong performance of the financial and insurance activities sector.

This was largely due to higher profits from the banking sector, driven by higher net interest income – a measure of the difference between what banks earn from loans and pay on deposits.

Pictured: Financial and insurance activities represents the largest economic sector in Jersey. (Statistics Jersey)

The financial sector now makes up nearly half (46%) of Jersey's economy, and accounts for more than half of all private sector output.

Labour productivity in this sector – the amount produced per worker – rose by nearly 20% last year.

This means that the finance sector produced more output per worker in 2023 compared to 2022.

Outside the financial sector, however, productivity rose by just 1.8%.

Not all sectors of Jersey's economy performed as well as finance. Some industries experienced growth, while others struggled:

Growing sectors:

Declining sectors:

Jersey's economy is growing, but the reliance on the financial sector remains high.

While this sector brings substantial wealth and productivity, the struggles of industries like real estate, agriculture, and the arts suggest a need for economic diversification.

For residents, the growth in GDP and GDP per capita indicates rising wealth and improved economic conditions.

However, uneven performance across sectors shows that not all parts of the economy are benefiting equally from this growth.

To read the report in full click HERE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.