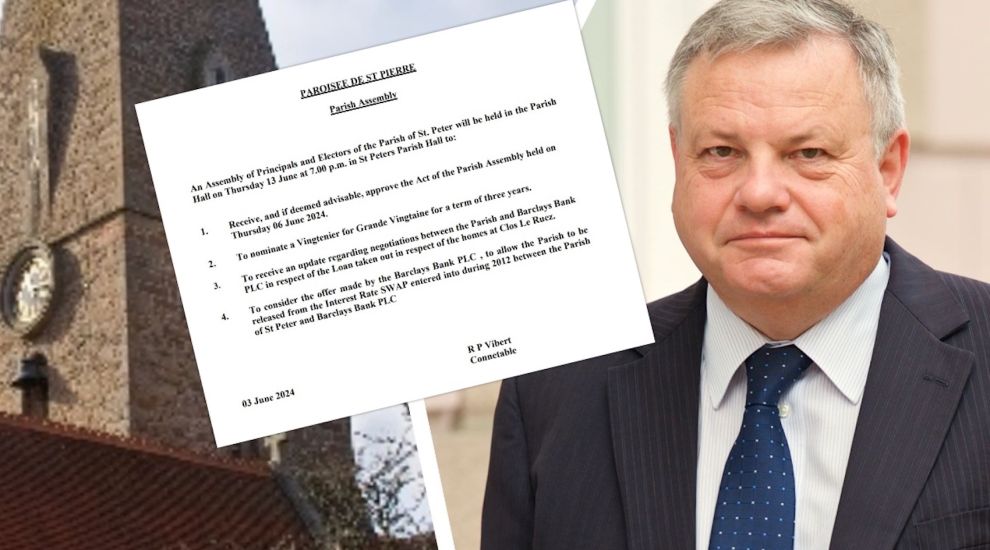

A parish which believes it was unwittingly swept up in a mis-selling scandal appears to have moved a step closer to resolving the multi-million loan issue – but is keeping details of the potential solution secret so as not to "prejudice negotiations" with the major UK high-street bank involved.

St Peter held a Parish Assembly meeting on 13 June, during which an update was given on negotiations between the parish and Barclays Bank regarding a £3.5 million loan taken out more than a decade ago.

The money was used by St Peter to build its Clos Le Ruez sheltered homes.

Parishioners were being asked to consider an offer made by Barclays to allow the parish to be "released" from an interest-rate swap it entered into with the bank in 2012 as part of the Clos Le Ruez loan.

This was something sold by many banks at the time to supposedly protect customers against rising interest rates and provide greater certainty on loan repayments.

However, St Peter believes it was mis-sold the swap, which was fixed at a rate of 7.27% over 25 years for 100% of the loan’s value.

Pictured: St Peter took out a £3.5m loan more than a decade ago in order to build its Clos Le Ruez sheltered homes.

The parish was ultimately unable to benefit from years of historically low interest rates, with Constable Richard Vibert previously stating that St Peter has paid "hundreds of thousands of pounds" of additional interest as a result – money which "could have been used for parishioners".

Express understands that a decision was reached at last month's meeting, but that those in attendance were asked not to divulge details.

Contacted by Express, Constable Vibert said that he could not reveal what was decided or discussed in relation to that part of the agenda.

Pictured: Constable Richard Vibert said that he could not share the details of last month's meeting as there were "still some negotiations to conclude".

The minutes from the meeting could provide some insight, but they will first need to be approved as part of the next agenda before being published.

"There will be a record of the meeting, we are just going through that process now," the Constable said.

He added: "But while the parish had the meeting, there are still some negotiations to conclude so we must be careful not to prejudice those negotiations."

Pictured: Parishioners were asked to consider an offer from Barclays regarding the interest-rate swap.

The parish has been forced to fork out tens of thousands of pounds on legal fees to deal with the saga so far, having allocated £10,000 last January, and another £30,000 in May 2022.

That money is coming out of reserves.

St. Peter is not the only parish to have been adversely affected after buying an interest-rate swap.

St. Brelade was sold one in 2011 when it took a loan to expand and refurbish its Maison St. Brelade care home. However, the parish is not taking action because its repayments have evened out after rates started rising at the end of 2021.

A Jersey business which has suffered greatly after being sold a swap is one of Jersey’s best-known antiques and home-interior stores, David Hick Interiors at Carrefour Selous.

Pictured: David Hick put his business up for sale after being caught up in the mis-selling.

So affected by the scandal was owner David Hick, who engaged in litigation with lender HSBC, that he decided to put his firm up for sale last year. He said it had "impacted heavily" on his health and wellbeing.

Did you attend the meeting? If so, please get in touch by emailing jamesj@allisland.media or calling 01534 887740.

Our team are happy to speak in strict confidence.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.