The promoter of a later iteration of the infamous Jersey tax avoidance scheme once used by Jimmy Carr have been hit with a £1m fine after a legal challenge by HMRC.

Hyrax Resourcing was handed close to the maximum allowed fine by the Tax Chamber of the UK’s First Tier Tribunal for failing to disclose their scheme to HM Revenue and Customs as legally required.

HMRC and the Tribunal said they hoped the fine would act as a deterrent for tax avoidance promoters.

The ‘Hyrax’ scheme involved its high earning clients quitting their jobs and being ‘rehired’ by a UK trust.

They would then be paid the National Minimum Wage, with the rest of their income made up of loans transferred to an offshore trust in Jersey – meaning they didn’t pay tax on all their earnings.

It was the successor to the infamous K2 scheme, which was described by former Prime Minister David Cameron as “very dodgy” and “morally wrong” after it emerged in 2012 that it was being used by over 1,000 people, including comedian Jimmy Carr, apparently losing the Treasury £168million per year.

But despite criticism from the top level of government, a subsequent investigation, and new anti-tax avoidance legislation being introduced every year since 2014, it was not the end of K2.

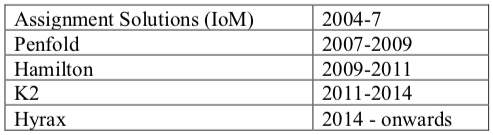

In fact, K2 was just one in a long line of schemes stretching back to 2004.

Pictured: Hyrax was a spin-off of K2, which itself was a successor in a long line of tax avoidance schemes.

However, in 2019, HMRC scored a victory when the First-Tier Tribunal ruled that it should be paid £40m in uncollected taxes.

In her judgment at the time, Judge Barbara Mosedale likened the Hyrax scheme to a “phoenix.”

Under Disclosure of Tax Avoidance Scheme rules, which are known as DOTAS, scheme promoters are required to share details of schemes they promote from the date it is first sold, as well as details of their users.

On 13 July, the First-Tier Tribunal sat again – this time to decide what penalty should be imposed against Hyrax for the DOTAS breach.

Last week, the Tribunal sat to decide penalty to impose for not notifying HMRC, and its judgment was shared publicly yesterday.

In deciding what sanction to impose, the Tribunal noted that Hyrax’s scheme involved “effectively splitting the tax saving with the scheme user”. With gross receipts in the period totalling more than £37.6m, it observed: “That means the tax saving was a very significant figure.”

The Tribunal also shut down arguments that HMRC “should have been able to recover the tax that was at risk”, stating: “Yes, they might be able to impose loan charges assessments etc on individual taxpayers but that would be time consuming, labour intensive and expensive. Although HMRC were aware, in very general terms, from the end of 2014 that Hyrax were involved in what they suspected was a tax avoidance scheme, because it was not notified and because HMRC had to have recourse to the Tribunal there was a considerable elapse of time. It would be disproportionate to have to pursue more than a thousand taxpayers.”

It also said it accepted HMRC’s argument that the penalty imposed “should act as a deterrent”.

“It should certainly do so to deter others from deliberately setting up a company with a sole director who can at best be described as displaying Nelsonian acuity in regard to the company’s affairs.

“It should also act to deter those who rely only on the advice of the promoter of the tax avoidance scheme and a promoter who makes large sums of money from it.”

Concluding, the Tribunal said: “We find that this was a very serious matter and the statutory maximum penalty is appropriate.”

The statutory maximum penalty is £600 per day. Applied to the Hyrax scheme from 9 April 2014 to 5 March 2019 (a total of 1,791 days), the fine totalled £1,074,600.

“This £1 million fine should serve as a stark warning to tax avoidance promoters. Those who ignore their legal duty will face serious consequences,” Mary Aiston, HMRC’s Director of Counter-Avoidance, commented.

“We actively tackle promoters of tax avoidance schemes and are determined to drive them out of business.

“We continue to use the full force of the law to challenge tax avoidance scheme promoters.”

Judge Anne Scott was sitting with Tribunal member Helen Myerscough. You can read the full judgment here.

HMRC scores £40m victory over controversial Jersey tax scheme

HMRC says it has no idea how much of £570bn offshore is evasion

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.