The panel of Jersey's top economic advisers is now forecasting a quicker recovery from the effects of the pandemic than they had previously expected - but they have also issued a warning about the way the island intends to repay its mounting debt.

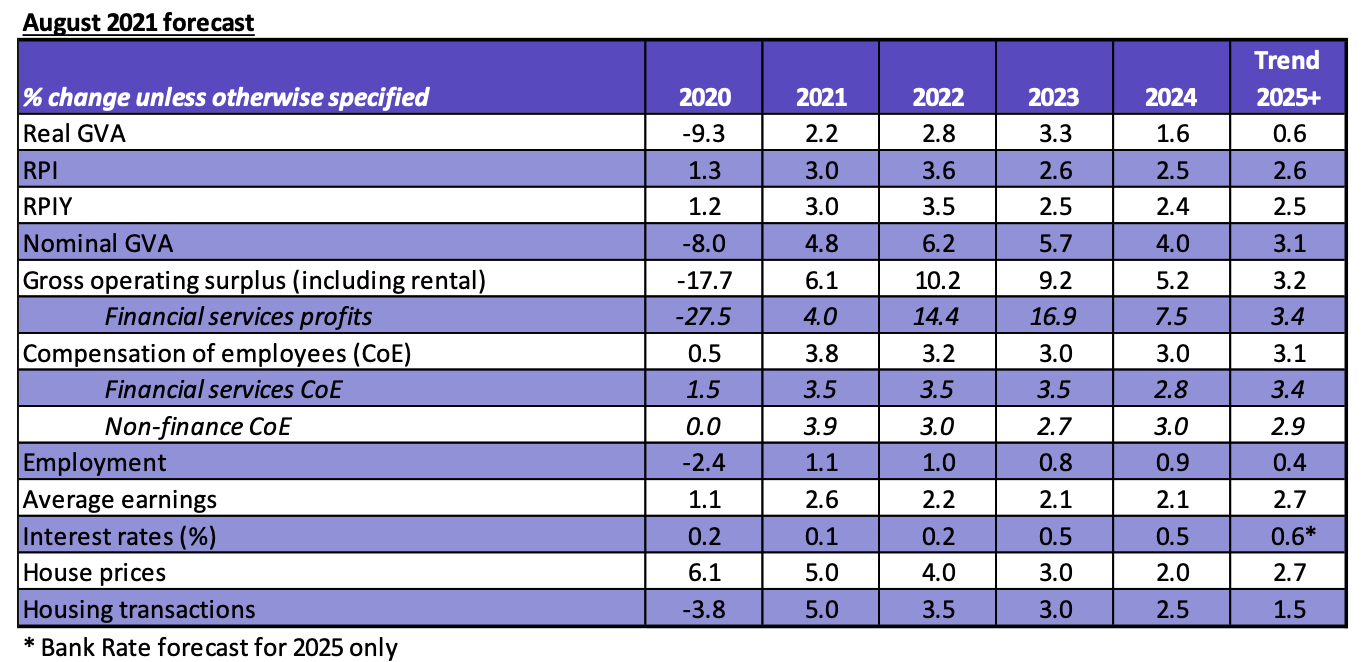

In their latest report, the Fiscal Policy Panel estimates that the island's economy shrunk by an unprecedented 9.3% in 2020, as the restrictions put in place to stem covid infections took their toll on spending, investment, confidence and jobs.

But, the Panel are predicting a return to growth of 2.2% this year, and 2.8% next year, which is better than their forecast in April of 2% and 2.1% for the same periods.

Pictured: the FPP's August economic forecasts.

The Panel also warned that government plans to borrow significant amounts of money in the next three years - taking the island's debt to more than £1.8 billion, not including interest payments - with repayments made from investment returns, was not without its risks:

"Repaying the borrowing through the investment returns on the Strategic Reserve will mean that (all else equal) the Strategic Reserve will grow more slowly than if the borrowing was repaid through, for example, increased taxes. The Panel has previously suggested that it would be prudent to aim to build the Strategic Reserve to 30%-60% of GVA. Therefore, a long-term plan is needed to grow the Strategic Reserve while also covering the borrowing costs from the investment returns.

"However, in the short-to-medium term, any surpluses that occur during the forthcoming Government Plan period should be prioritised to rebuilding the Stabilisation Fund."

The Panel is chaired by Kate Barker, who sits with Francis Breedon, and Richard Davies. They had "cautious optimism" that given the extent of the island's vaccination program, disruptions to the economy will now begin to recede. They also expects a temporary period of high inflation to gradually fall back over the course of 2022.

They recommended that the government should aim to bring the island's finances broadly back into balance by 2024 - there was a deficit of £113m in 2020 - and that there should be no new fiscal stimulus.

The Panel’s updated forecast is as follow:

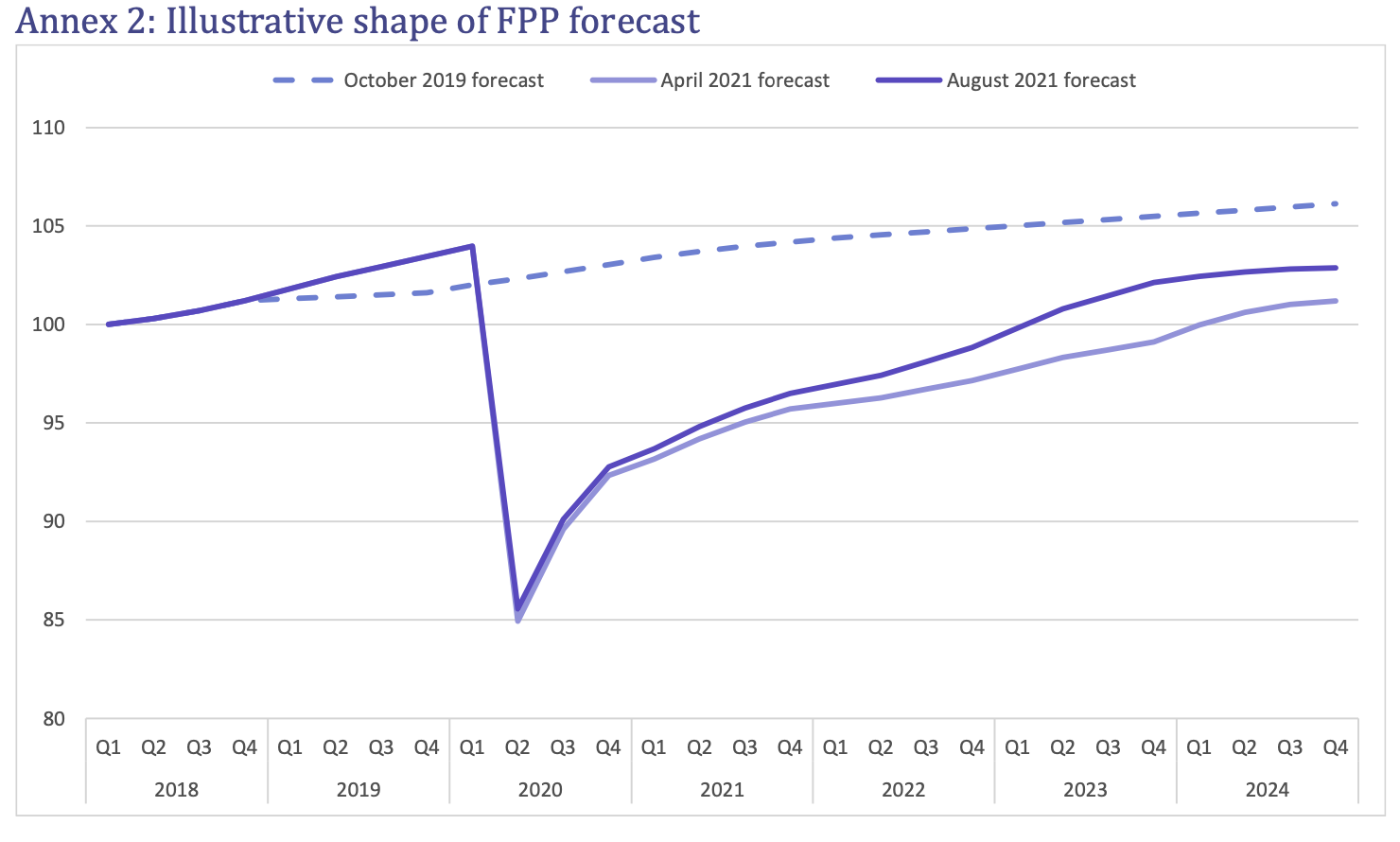

Pictured: the various FPP economic forecasts.

The Panel notes that one of the main reasons for the quick and deep economic contraction of 2020 was the reduced profitability in the banking sector, as a result of low interest rates. But the funds sector has done well:

"Also promising in terms of the financial services sector is the continued growth of funds under administration which grew in value by over 8% (to £410bn) in the first three months of the year. This follows the 9% growth in value experienced last year and is also accompanied by annual growth close to 16% in March in funds under management. While much of this can be attributed to higher asset prices, it also indicates the continued strength of the sector. Globally, asset markets have performed strongly, with many indices at record highs."

Minister for Treasury and Resources, Deputy Susie Pinel, said: “We welcome this letter from the Panel and officers are now considering its contents. The FPP perform a valuable role by being an independent expert voice, and Ministers appreciate their insight when developing the details of the Government Plan.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.