A Jersey financial services firm has defended its due diligence procedures after it emerged it had been involved with a company linked to one of the players in Singapore’s largest ever money laundering case – who tried to avoid police by jumping off a second-storey balcony.

Su Haijin (41), who used a Jersey-registered company to buy property in London’s iconic Oxford Circus shopping district, was one of 10 individuals arrested following a raid by the Singapore Police Force in August 2023 on suspicion of laundering the proceeds of overseas organised crime activities in the country.

It is the biggest case of its kind in Singapore's history, with the alleged criminal funds involved totalling nearly £2bn.

The extremely high-profile investigation involved more than 400 officers, and uncovered ill-gotten goods ranging from luxury cars, shelves of designer bags and watches, hundreds of pieces of jewellery, and even an expensive collection of unusual bear ornaments.

Last month, the final sentences for the 10 at the centre of the case were handed out, though Singapore news outlets have reported that 17 individuals remain in their sights.

Haijin, who is originally from China but holds a Cypriot passport, was reported to have arrived in Singapore in 2017. While there, he was said to have invested in the stock market-listed group behind a chain of seafood restaurants, as well as an air conditioning company and mobile phone dealership.

The charges brought against Su Haijin which ultimately led to him being jailed were centred around a company he owned, Yihao Cyber Technologies, incorporated in Singapore.

According to the Singapore Police Force, investigations revealed that the Cypriot national was involved in "unlawful remote gambling activities abroad".

In April, he was convicted and jailed for 14 months for one count of resisting arrest and two counts of money laundering.

During the police raid on 15 August last year, Mr Haijin jumped from the balcony of his master bedroom on the second floor in a bid to escape – badly injuring himself in the process.

Haijin, who fractured his wrists, femur and heels, was subsequently found to be hiding in a drain near his house and placed under arrest.

The police also seized about £100m worth of assets, including cash, properties, jewelleries, luxury items and alcohol from Mr Haijin, his wife and his companies.

Police also released a photo of a collection of 60 'BE@RBRICK' figurines – collectible plastic toy bears produced by a Japanese collectibles company, some of which can retail for up to $600.

But perhaps some of the most elaborate assets attached to Haijin's name were properties acquired in 2021 with the help of a Jersey-based entity.

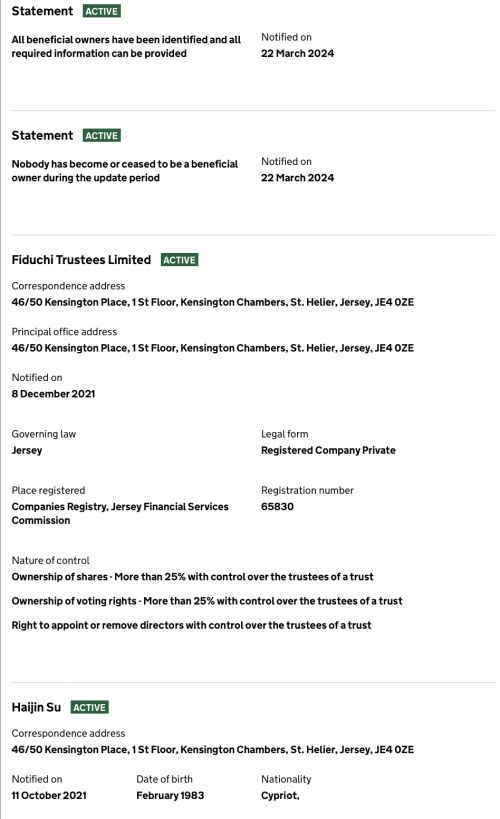

Records on Companies House show that Mr Haijin is the beneficial owner of the Jersey-incorporated company New Yihao. Local financial services firm Fiduchi Trustees Limited is also listed as a beneficial owner.

The Organised Crime and Corruption Reporting Project (OCCRP) reported alongside Radio Free Asia that New Yihao was used to buy property in London for more than £43m.

This included a building at 283 Oxford Street, currently used by trainer and sportwear retailer Foot Locker as one of its stores.

Pictured: A Companies House listing for New Yihao.

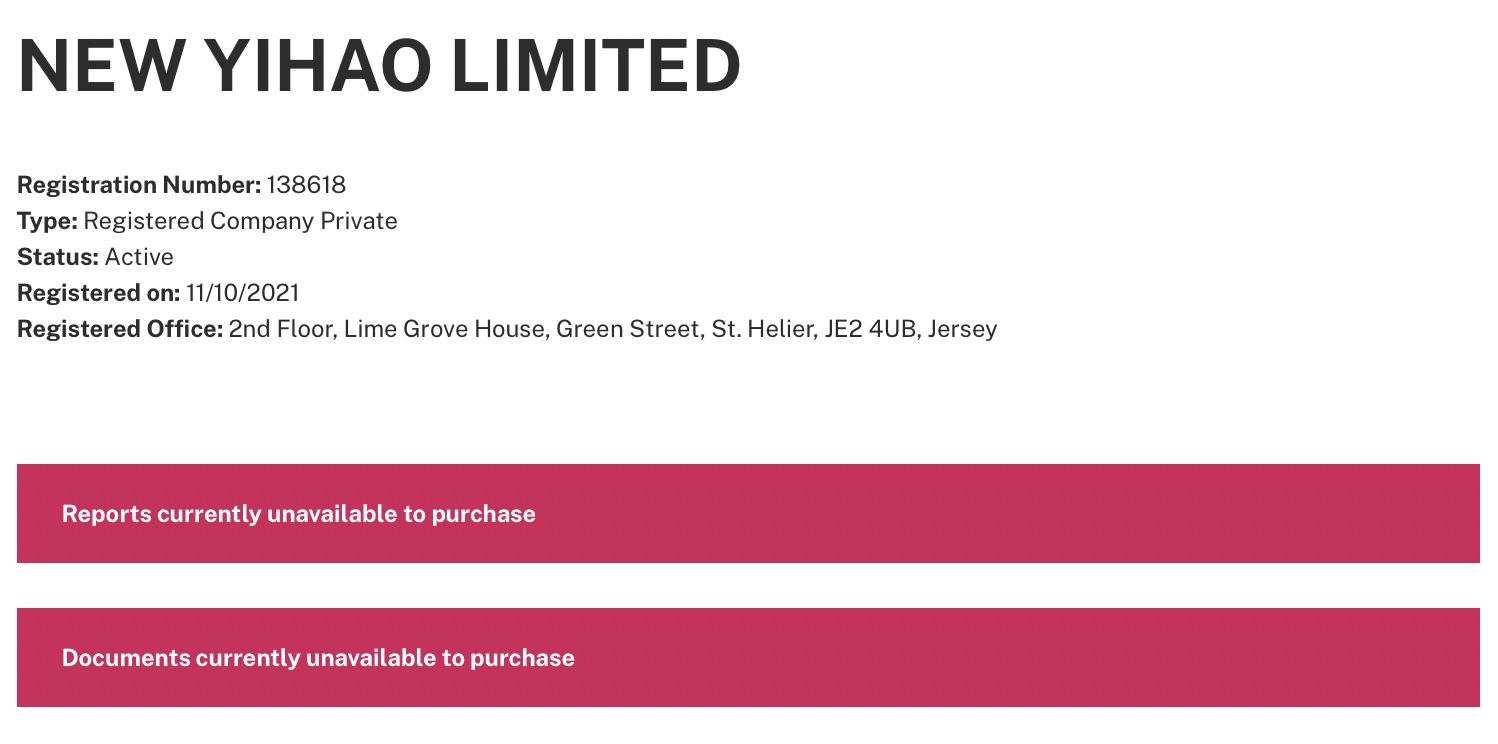

A search of the JFSC Companies Registry by Express showed that the company was incorporated on 11 October 2021.

At the time, its address was listed as being the same as Fiduchi – at the time, 46/50 Kensington Chambers – and Fiduchi Nominees Limited was listed as the subscriber to the Memorandum of Association.

A change of address was registered on 2 April 2024 to 2nd Floor of Lime Grove House on Green Street, Fiduchi's current premises.

While the company remains listed as 'active' on JFSC Companies Registry, reports and documents are no longer available to view online.

Pictured: The JFSC website as of this morning.

The Companies House listing, which lists Su Haijin and Fiduchi Trustees Limited as beneficial owners, still remains live.

Asked for comment by Express, a spokesperson for Fiduchi said: “At Fiduchi, we strictly adhere to all applicable laws and regulations, performing comprehensive due diligence on each customer. We always strive to maintain the highest ethical and legal standards, diligently fulfilling our responsibilities to all stakeholders."

They continued: "We are committed to supporting and fully cooperating with the authorities in any investigation.

"Our commitment to confidentiality and professional integrity prevents us from discussing specific client affairs in more detail.”

Express also asked Jersey's Law Officers Department if it assisted the investigation in any way and was told that: "The Law Officers’ Department is unable to comment on individuals or entities that may or may not be under investigation."

Meanwhile, a spokesperson for the Jersey Financial Services Commission said: “Where appropriate, the JFSC exchanges information with both domestic and international regulators and law enforcement agencies.

"We’re unable to comment on specific investigations.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.