"Early analysis" suggests controversial changes to GST on imported goods has added at least £4m to public coffers since last July – nearly four times original predictions, it has emerged.

On 1 July 2023, the de minimis threshold— the value at which islanders must pay GST on imported goods—was lowered from £135 to £60 in a move the government said aimed to benefit local bricks-and-mortar retailers by minimising the incentive to shop online.

Larger online retailers also became subject to the same rules as the island's stores, meaning orders of any value from companies such as Amazon were subject to the 5% sales tax at the point of purchase.

Pictured: Treasury Minister Deputy Elaine Millar.

Following the move, a £100 item now costs £105, with the £5 tax going directly to the Jersey government.

By March of this year, 44 large online retailers with an annual Jersey-related turnover above the £300,000 minimum required to levy GST on all online goods had registered to charge the tax.

Former Treasury Minister Ian Gorst had previously predicted that the changes would add at least £1.1m annually to the public coffers – but the actual revenue appears to have far exceeded that figure.

The government has recently estimated that the additional GST receipts from these retailers have brought in more than £4 million.

Answering a written question from Deputy Raluca Kovacs on how much revenue the changes had netted the government, Treasury Minister Elaine Millar said: "Early analysis suggests that the first full year's additional GST receipts from the mandatory registration of online retailers may exceed £4m."

"This arises from the registration of offshore retailers and the consequent reduction in the number of importations to which the de minimis level could apply," she continued.

Pictured: Over £125 million in revenue has been collected by the government since introducing controversial changes to the taxation of imported goods last year, according to the Treasury Minister.

"The majority of goods bought from these large offshore retailers now attract GST in the same way as goods bought from Jersey retailers, fulfilling a long-standing commitment of successive governments since GST was introduced."

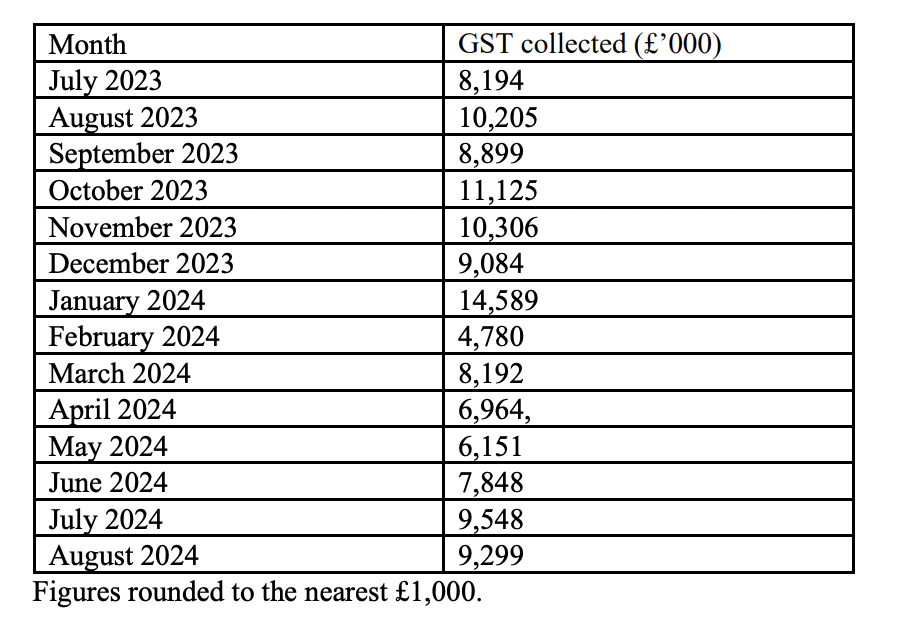

Monthly GST collections have fluctuated since July last year, peaking at £14.59m in January 2024 as a potential consequence of the Christmas present rush and reaching their lowest point the following month at £4.78m.

In total, approximately £125.18m was collected, while the average monthly collection is around £8.94m.

While the government said the move was designed to help island stores in the face of fierce competition from online retailers when they brought the changes in, many local businesses were sceptical about these claims.

Picutred: The four-million-pound figure is substantially higher than the amount predicted by former Treasury Minister Ian Gorst when the measures were first proposed.

Voisins Department Store owner Gerald Voisin told Express' sister publication, the JEP, earlier this year that the GST changes had "made no difference" to his business.

"I always thought it was disingenuous to say that the government are doing it to help retailers when they were doing it to raise more tax," he added.

In her recent response to Deputy Kovacs, Deputy Millar also confirmed that the government had spent over £190,000 upgrading the Customs and Excise System to support the new regulations.

An additional £9,150 was paid for research to improve the user interface for this system.

Four new staff were initially hired to assist with the new processes, with staffing costs totalling £232,736 since June 2023.

Online retailer GST estimated to bring in extra £1.1m a year

23 online retailers registered for GST this year – but names are confidential

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.