Around £5m in overclaimed covid-19 financial support is still yet to be recovered by the Government, it has emerged.

The figure was included within the latest update from the Comptroller and Auditor General (C&AG), whose remit includes the audit and consideration of public funds to help ensure islanders are getting value for money.

The 'Tackling Fraud and Error report', published today, includes data on outstanding debt relating to the various financial support packages rolled out by the Government at the height of the pandemic.

Pictured: The financial impact of the Covid pandemic saw many businesses fighting to stay afloat.

Businesses were able to apply for this support through initiatives such as the Co-funded Payroll Scheme, as the Government sought to mitigate the impact of public health measures on the island's economy.

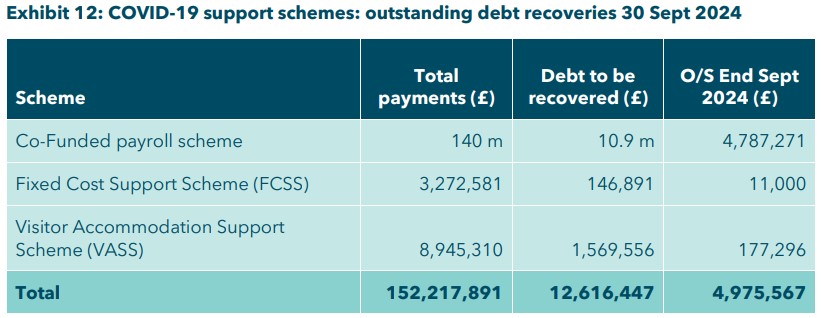

However, as Lynn Pamment notes in her report, it later identified around £12.6m in overclaimed support across the schemes that were introduced.

It has since been recovering the debt, which stood at less than £7m this time last year.

Pictured: Lynn Pamment is the Comptroller and Auditor General.

Ms Pamment wrote: "Levels of identified overclaims of financial support from Government increased during the Covid-19 pandemic with the introduction of new schemes to provide support for businesses and individuals."

The report stated that, at the end of September 2024, £5 million had yet to be recovered.

The bulk of the outstanding debt (£4,787,271) stemmed from the Co-Funded payroll scheme, while the Fixed Cost Support Scheme and Visitor Accommodation Support Scheme accounted for £11,000 and £177,296 respectively.

Pictured: A graph showing the unrecovered debts stemming from the various Covid financial support schemes as of September.

Regarding the former scheme, Ms Pamment recommended that the Government "prioritise the completion of the reconciliation of CFPS claims made to other records held in respect of the employers making the claims".

"These reconciliations should be carried out as soon as possible," she added.

Asked for comment by Express, Treasury Minister Elaine Millar said; “Due to the on-going challenges experienced by businesses in response to the pandemic, the previous government adopted a more flexible approach to debt recovery for those that had overclaimed from Covid economic support schemes.

"This included extended repayment terms and not pursuing debts in court, to prevent undermining the success of the economic support schemes in keeping businesses trading."

She continued: "This policy was continued to help with the cost-of-living pressures that followed.

"Now that rates of inflation are forecast to decline and the businesses have had time to recover from the financial stresses of the pandemic, ministers are re-evaluating the approach to recovery of this debt with a view to ensuring those with outstanding debts are actively engaged on an affordable repayment plan."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.